Table of Content

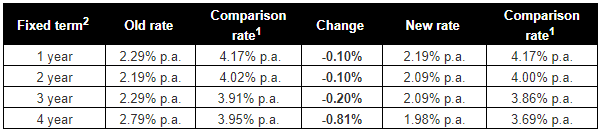

In addition to interest-saving loan features, it’s also important to consider a loan’s fees, as these can mount up over time. Use Savvy’s home loan comparison calculator to find out how upfront and ongoing fees can make a difference to the overall cost of your home loan. However, note the comparison rate does not account for fees that may be encountered in situations where you have a choice of action. For example, a comparison rate won’t consider fixed loan break fees – also known as early exit fees – which may be charged if you decide to refinance to another loan and break a fixed term loan. Present with a very good credit score – preferably with a credit score over 750.

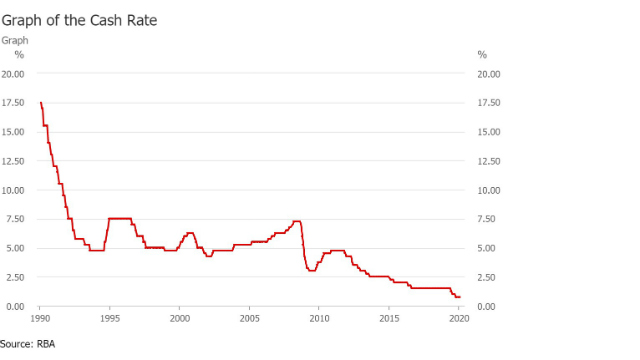

The interest rate offered to borrowers reflects the level of risk a lender thinks they may be taking. The higher the risk, the higher the interest rate charged and vice versa. Depending on what type of home loan you have, you may make principal and interest repayments, or interest-only repayments. For more information on comparison rates please refer to our important information below. Lower interest rates are key to generating big savings on your home loan. Fortunately, you’ll have all the expertise behind you at this stage to make an investment choice, but it can always pay off to be clued up in the market yourself!

Best home loan rates

The interest rate determines your borrowing costs, and the lower the rate, the less interest you pay each month. From there, you can plan a budget with your home loan repayments in mind. It’s important to keep in mind that a good home loan isn’t always one with the lowest interest rate.

Borrowing $#_KEY_LOAN_AMOUNT_# over 30 years paying interest only. Receive $3,000 when you take out or refinance with a Suncorp Bank home loan of $500k+, LVR ≤90%. There are several reputable credit report providers in Australia, including Equifax, Illion and Experian. Everyone is entitled to receive one free credit report a year, so get online to check out your credit report today. It is in the interest of your lender to keep its customers than have you going to another lender. The amount you will be able to borrow differs widely from person to person.

Compare Home Loans

Under the Offer, eligible customers may benefit from a discount. Equity in a home is the difference between the value of your home and how much you owe on the mortgage. For example, if your property is worth $500,000 and you still owe $300,000, your equity is $200,000. Our equity calculator can help you work out how much equity you have in your property. Interest rate rises are coming thick and fast, but you may be able to give yourself a rate cut by refinancing to a better home loan deal.

Raj went out of his way to expedite our home loan application during the challenging COVID period. He explained in detail our different options, the application and approval process, and also savings tips! We are really grateful for his assistance, super satisfied with our outcome, and highly recommend his services.

Blockchain Mortgage

But, if you're after a quick view on home loan choices, we've got you covered below. Shopping around for a better interest rate can save you thousands of dollars. You may want to even consider refinancing with your current lender or switching to a new lender.

You can save thousands of dollars on your interest just by getting the best rate. If you already have a home loan, you might even want to consider refinancing with your current lender or a new lender that can offer you a better rate. Offering a Refinance Cashback of $2,000 to customers who refinance their home loan from another financial institution to CommBank.

Applying For A Mortgage

The bigger banks typically have more resources available to borrowers in the way of customer service. Whenever the risk is increased, interest rates will be higher also. Reduce your loan term – a longer loan term may increase your borrowing power, as the repayments will be less, but a shorter loan term means you pay less in interest overall over the life of the loan. Therefore, if you can make larger repayments by reducing your loan term , you’ll ultimately receive a cheaper loan.

Like most borrowers, she wants to save as much money on interest repayments as she possibly can. After comparing home loans with 100% offset accounts, Susie decides to calculate just how much a 0.25% p.a. Difference in interest rates could make to the total cost of a loan. The fees and charges that are included in the comparison rate include loan establishment fees, on-going account-keeping or administration fees and annual account charges.

We’ve selected some of the best home loans on the market with some of the lowest interest rates, low fees and useful features. Another factor to consider when shopping for a home loan is whether you want a fixed rate or variable rate home loan - or perhaps a split loan. However, as a result of the cost of added overheads, big banks often charge higher interest rates and fees than smaller lenders. Plus, smaller lenders tend to offer more flexibility and innovative technology. Making additional repayments onto your mortgage could allow you to get ahead of schedule on your loan term and closer to paying off your home loan, reducing your total interest repayments. The more frequently you make regular loan repayments, the less interest you will have to pay as interest is calculated daily.

Update your borrowing amountto see the rates or choose another option in the drop down. Quickly find a home loan to suit your needs, whether you’re looking to invest, refinance, or buy a home. The fastest way to find out what the lowest interest rates on the market are is to use a comparison website. Unfortunately, there is no one lender that offers the best rates in Australia.

For example, if you have a loan of $200,000, but $20,000 in your offset account, you’ll only pay interest on $180,000 of your principal. Many Australians have their wages or salary paid into their offset accounts. This is a rate which shows as a single figure our current standard interest rate for the loan plus certain standard fees and charges . If your current lender can't offer you what you need anymore, it may be time to refinance your home loan.

No comments:

Post a Comment