Table of Content

Combined cost of application, settlement, discharge and ongoing fees . Since 1995 we've been helping Australians learn about home ownership, compare home loans and get help from home loan specialists to find the right home loan for them. It’s always important to shop around for a competitive rate but even more so with an investment home loan, as interest rates are generally higher. Many first home buyers are going in with a deposit smaller than the recommended 20% so a home loan with a maximum loan-to-value-ratio of 90% or even 95% is something to consider. Of course, this means you will need to pay Lenders Mortgage Insurance . The Bank of Mum and Dad is a big business in Australia, with more than half of all first home buyers getting financial help from their parents.

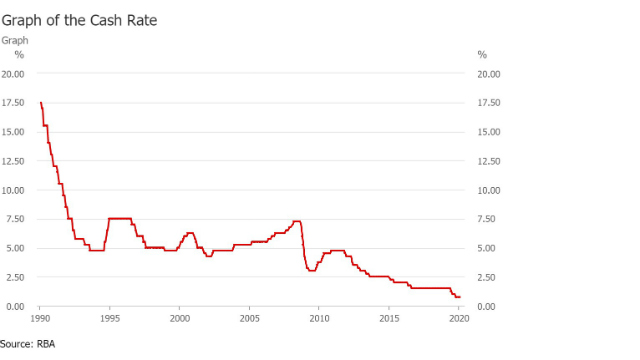

A low rate is great but it doesn’t fully reflect the total costs of your loan or managing your mortgage. Make sure you understand all the fees, conditions and features of a product, and then weigh up the rate against other costs over time. For example, having access to certain features — such as fee-free additional payments — could justify selecting a slightly higher rate. We’ve previously outlined a holistic approach to choosing the best loan and comparing home loans. Home loan interest rates vary depending on a range of factors including the official cash rate, market conditions, decisions by the lender and so on.

Rezoning Property

This is one of the ways RateCity makes money and how we can offer our comparison service to you for free. If you discover that you’re paying a higher interest rate than is generally available, don’t feel shy about negotiating with your lender. It’s OK to contact your lender and ask whether they can offer you a cheaper home loan interest rate. As a valued customer, your lender will want to do everything possible to keep you as a client and may be willing to offer you an incentive to ensure you remain with them. Check back with Savvy regularly to make sure you’re getting the cheapest home loan rate in Australia. Use an offset account to park your wages and any savings you may have.

So it's important to have a good understanding of what will work comfortably with your budget. The time you take to pay off your loan will affect the amount of interest you pay. Paying your loan off over a shorter period will minimise your interest repayments. As you gradually pay off the money you borrow, you will be paying interest on a smaller loan amount and your interest payments will slowly reduce. For example, your interest repayments when you first start paying off a $500,000 loan will be much larger than when you've paid off half of the principal amount, and interest is only payable on $250,000.

How much is your next property worth?

With so many interest rate options and repayment types available, finding the cheapest home loan may depend on the type of loan you choose. The interest you're charged on each mortgage repayment is based on your remaining loan amount, also known as your loan principal. The rate at which interest is charged on your home loan principal is expressed as a percentage. Larger mortgage lenders such as the big four banks tend to offer customers more facilities than smaller lenders, including local bank branches for in-person banking. The longer you take to pay off your loan, the more interest you will end up paying.

This is a selection of lenders that includes large banks, credit unions and smaller online lenders. You may find a loan with a lower rate or more suitable features somewhere else. With so many different home loan products on the market, it's easy to feel spoilt for choice. But it can also be difficult to work out which home loan is best for you. Home loans with offset accounts allow you to reduce the principal amount that you need to pay interest on by "offsetting" the loan principal with your savings. It's a powerful and free way to super-charge your mortgage repayments.

Construction Loan

Ensure that there is a high likelihood that you’ll qualify for a home loan before you apply. The way the credit system works, each application for credit is recorded against your name. Multiple entries in a short space will more than likely lead to rejection. Other factors that lenders may consider to assess your eligibility are your income, assets, liabilities, employment and credit history. The package usually means you can avoid fees on some of the products.

Home loans can be expensive, which is why our comparison service is 100% free. Lenders pay us a commission while you pay nothing to find a great loan. Mr Hogan says intervention could involve restructuring the terms of loans to keep people in their houses, or a way for people to sell out in a property market without incurring huge debts. "The housing market trajectory follows the cash rate – so with expectations that that peaks in mid 2023, that's when we could start to see a floor in the housing market." Before rates started rising, around a third of gross household income was needed to service a mortgage, according to data analysis by CoreLogic and ANU Centre for Social Research and Methods. Experts estimate almost 300,000 borrowers who took out home loans in the two years to May are at serious risk of default or forced sales.

Buying your next home

Find out how much you could potentially borrow to put towards your home loan with our borrowing power calculator. Our mortgage brokers will provide you with home loan packages that suit your needs, but there's no pressure to commit until you're absolutely ready. We do not compare all brands in the market, or all products offered by all brands. At times certain brands or products may not be available or offered to you.

"We talk about their budget, about disposable income, about their repayments, and if it's getting tighter, we advise them to sell it." "We talk about exit strategy most of the time," Mr Weldemariam says, referring to the advice he's giving his clients who are struggling with rate rises. Mr Doull reckons they have about six months worth of savings to get them through interest rates of around 6-7 per cent. Mr Doull says they'll need to find another $1500 a month to service their mortgage, at a time when they'd like to be planning for their first child. To spare you the hassle of shopping around, we have listed the best interest rates from our panel of 40+ lenders. We will not combine the $2,000 cashback offer with our MAV fee waiver.

You may have to pay switch fees, mortgage discharge fees or early exit fees , but overall refinancing regularly to a loan with a lower interest rate or lower fees is a good idea. This is used to determine the interest rate charged on individual loan products. The interest rates shown here are our current standard rates and don’t include special rates that you may be able to ask for. The Interest rate is the advertised indicator rate for the home loan plus/less any margins. Lenders have wasted no time in hiking mortgage rates, but some are offering much lower rates than others so there are still savings to be had.

Start your home loan comparison at RateCity and compare interest rates today. On a 30-year loan term, her monthly principal and interest repayments will be $2,951. The total interest she will end up paying over the life of the loan is $362,442.

A comparison rate is another tool that may help you to better judge the cost of a home loan. Comparison rates take into consideration many of the fees a home loan lender will charge, as well as the interest rate, to calculate a “truer” cost of the mortgage. The comparison rate is based on a $150,000, 25-year home loan paying principal and interest. Whether you're a first home buyer, a long-term investor, or want to refinance, finding the best home loan rate is going to be a priority for you. In fact, the right home loan for your financial needs and budget may have a higher rate than others but offer additional perks, like a packaged credit card or an offset account. That will depend on how you manage your finances and what your overall financial situation is.

Here’s what your monthly repayments, total loan cost and total interest paid over the life of the loan could look like depending on how high or low your interest rate is. Different home loan products charge different interest rates and fees, and offer a range of different features to suit a variety of buyers’ needs. Look at the interest rate, rate type , loan fees, features, loan term, repayment frequency and more to find a home loan that fits with your budget and property goals. Some lenders allow you to delay repaying your debt and simply pay the interest charges for a limited time . Compare home loans and home loan rates from a wide range of Australian lenders, and find a mortgage offer that suits your needs.

Borrowing power is determined largely on your deposit amount, your earnings and ability to pay back your loan and to keep up with your on-going loan repayment commitment. Don’t be surprised if you get a call from your bank offering cashbacks and competitive rates. Australian banks often offer special interest rate discounts to their best customers. Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. Finder.com.au is one of Australia's leading comparison websites. We compare from a wide set of banks, insurers and product issuers.

Your bank will take the outstanding loan amount at the end of each business day and multiply it by the interest rate that applies to your loan, then divide that amount by 365 days . Manage your loan online Redraw, change your repayments or loan type to better meet your needs and more. See what options are available to home loan customers needing financial assistance. To be eligible for a home loan you will need a borrowing amount of at least $10,000. Wealth Package rates require a minimum initial package lending balance of $150,000.

No comments:

Post a Comment